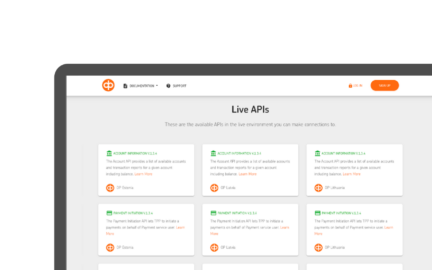

Custom PSD2-compliant API

An individual PSD2-compliant API for one of the Nordic bank’s own network

- Custom Software Development

- 2019

- Industry: FinTech

Initial Task

Description

Alongside the implementation of PSD2-compliant “aggregator” API for Nordic banks, one of the bank networks addressed us with an untrivial request to individually set PSD2-compliant API for their own network.

Transactions coming from the new PSD2 application should’ve been synchronized with the legacy client’s ledger.

Technology stack

BackEnd

Challenges

Strict Deadlines

The development team had to meet very strict deadlines adjusted by the EU legislation coming into force.

In-Memory and Distributed Caching Mechanisms

As the data coming from the new API had to be synchronized with a legacy ledger with poor performance, we've had to implement in-memory and distributed caching mechanisms to meet the performance requirements.

OAuth2 + Open Id Connect

The task implied a personal approach and was complicated by plenty of work with Securing APIs with OAuth2 + Open Id Connect, demanding solid expertise and thinking out of the box.

High-End Bulk Payment API

Implementation of high-end Bulk Payment API providing fast and error-free performance was quite challenging due to huge amount of input data that required compressing, splitting and parallel processing.

Workflow

Overall Result

1. The team managed to keep to a very strict schedule, thus preventing the Client from receiving fines from the government.

2. The required PSD2-compliant API was successfully launched and the entire functional set was implemented the way that adding new custom features was not a problem at all.

3. The executed work has become a good basis for future similar projects as the use of similar code is now available for the deployment of the other client’s projects.