Banking app

Mobile banking software development for the leading Finland savings bank

One of the best examples of staff augmentation cooperation model, where our unmanaged team of experienced iOS, Android and QA engineers has completely reworked and significantly expanded mobile application of one of the leading Finnish banks.

- Staff Augmentation Service

- 2018 – ongoing

- Industry: Fintech

Initial Task

Description

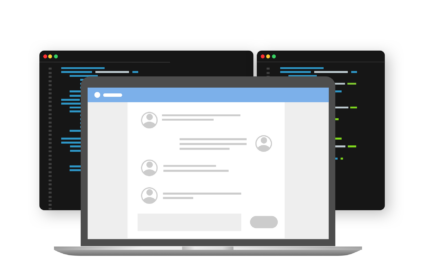

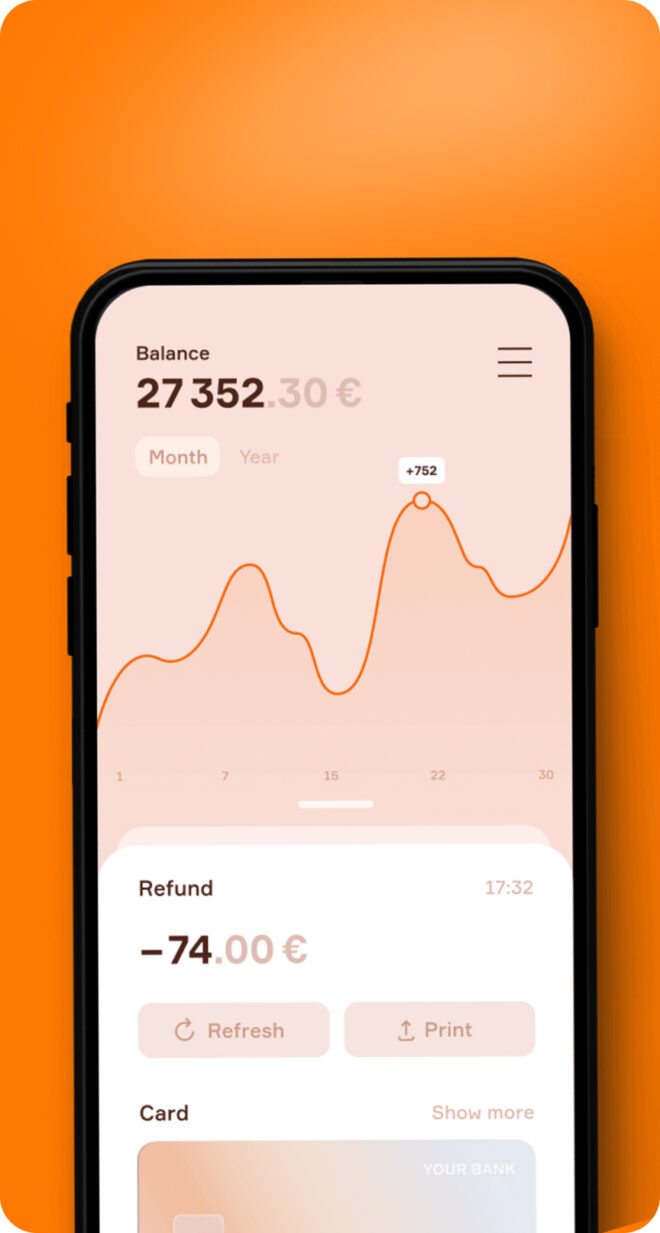

The app is essentially a client-oriented tool that helps the users engage with banking services. It should provide user-friendly tools for working with accounts, cards, transactions, balances and so on.

The Client was looking for a reliable and devoted technical partner that could confirm its top-level expertise and self-discipline, provide a wide technology stack and comply with strict security regulations.

As our client was unhappy with the app’s performance and wanted to expand its functionality in the future, an initial assignment was to partially rebuild the client’s mobile banking application, including:

- Major functionality & privacy improvements

- UX/UI design concept & realization

Technology stack

iOs

Android

Challenges

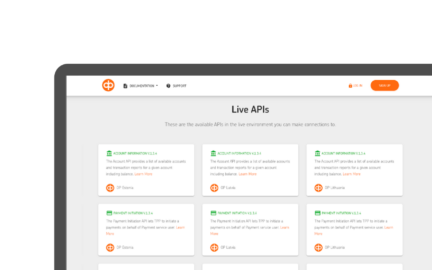

Next-generation API

Our team was required to uplink to a next-generation API, based on Samlink solution (the key IT provider to the financial institutions in Nordics).

Design concept & implementation

With no design reference sheet, the development team was to revise the main design concept from the very basics as well as the app’s core infrastructure. Also as the backend layer was thin and not client-focused, the app needed to be capable of handling lots of business logic on its end.

Modern Technologies for Maintainability

The team was to be very considerate and thoughtful when rewriting the existing app in a cleaner and more maintainable way, using more modern libraries, patterns and solutions. We needed to optimize the app's performance to ensure smooth navigation, responsiveness and crash-free behavior.

Security Measures

The team was challenged to implement the robust security measures to safeguard user data and protect against potential threats, as well as full and secure CI integration, maintain high levels of test coverage and code cleanness.

Process

Phase / 01

Discovery, Tech Consultancy and Team Formation

-

Our team has taken a thorough review of the existing app, its functionality and code base to understand the starting point.

After having conducted an extended client’s interview to understand the needs, plans and pain points we have come up with a detailed plan and road map of the project redesign and bug fixing, including covering aspects of team composition and tech solutions to be implemented. -

Further there were several rounds of communication with the Client’s PM and design team looking for technical consultancy on app features to be implemented later while backend mobile banking app development services were hosted on the Client’s side. UX/UI solutions, offered by the Customer, were all polished and optimized to bring in the best user experience.

Phase / 02

Project Development

-

Seamless API reintegration with Samlink servers alongside with the new app functionality and custom options were to be developed. Furthermore, the team ran multiple tests to avoid possible issues with API that could affect user data. As a result, there were no even minor errors in production.

-

‘Clean architecture’ pattern implementation and unit tests allowed us to optimize the development process making the code injections more precise and error-free. A plain ‘storyboard’ development approach was effectively substituted with a more reliable and safe ‘in-code’ method.

Phase / 03

Further Major Updates

-

Further our team was puzzled with:

- Biometrics integration (Fingerprint and Face ID authorization);

- Support of new card types (VISA);

- Google Pay and Apple Pay credit provisioning with further certification.

-

New chat development: full development and integration of new chat for digital banking app with extended functionality, including new chat API, improved security, file sharing and new UI.

-

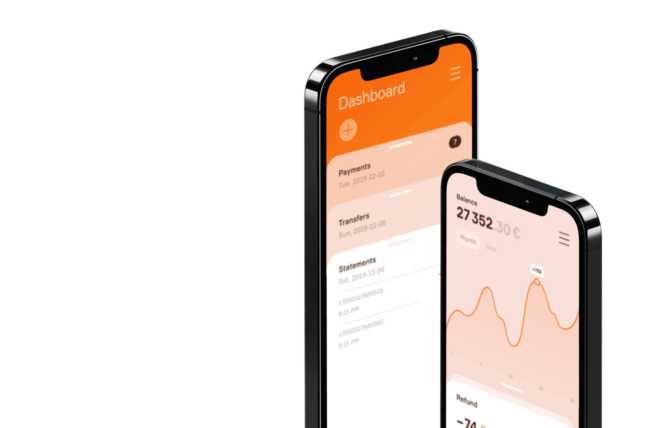

Implementation of multiple new features, such as Wealth module, charts, KYC, PIN viewing, reworked securities and funds sections.

Overall Result

Task summary

01.

Successful audit for user data security

In October 2019, the application was fully checked and successfully audited with the highest marks for user data security by NIXU Cyber Security - the largest Nordic company in information security consulting.

02.

Upgraded UX/UI and API

New design was positively reviewed by 85% of users.

Next-level API was developed, tested and released right on time.

03.

Payments

New VISA cards were technically implemented into the app payment system.

Successful Google Pay credit & Apple Pay integration.

Mobile banking application project development cost depends on technology stack (android or ios). Fill out the form below to create mobile banking software.

Client Review

Henna Leinonen

With Touchlane LLC, the platforms were delivered excellently. There have been approximately two to four major update releases per year depending on the size. They constantly delivered impressive results. They communicated well and were responsive to changing customer needs.