PSD2-compliant Bank Aggregator API

Multifaceted implementation of PSD2-compliant “aggregator” API for PSD2-compliant Nordic banks with software architecture enabling rapid onboarding of new banks to the platform.

- Staff Augmentation Service

- 2019 – ongoing

- Industry: FinTech

Initial Task

Description

The Client was in search of experienced specialists to enforce the development team and carry out the multifaceted implementation of PSD2-compliant “aggregator” API for PSD2-compliant Nordic banks.

One of the key requests was to make sure that the software architecture would enable rapid onboarding of new banks to the platform.

Technology stack

BackEnd

Challenges

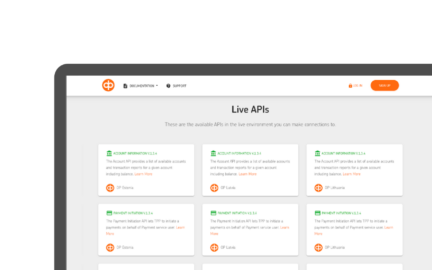

API Design

Even though PSD2 is a specification, it still left a room for interpretation, which spawned a diversity of PSD-compliant API flavours differing in API security protocols, authentication workflows, message formats and data structures. We had to design our Aggregator API to hide those differences, enabling a seamless integration for API clients. After analyzing then current state of APIs of Bank APIs in Nordics, Touchlane team proposed the API design that made both developers and end-users happy.

Microservices Architecture Design

As Client wanted to onboard more and more banks to the platform, we've proposed the microservices architecture design that allowed flawless onboarding on new bank integration, without interference with Aggregator API Core. That contributed to creation of 2 separate teams: one for new bank onboarding and another for Aggregator API Core development, which were able to work simultaneously reducing time to market.

Security Protocols and Authentication Flows

One of the most challenging aspects of this project was dealing with variety of security protocols and authentication flows. Provided that each bank has its unique API security, the team had to support a number of security mechanisms such as Basic Auth, Digest Auth, OAuth2, Mutual TLS, HTTP Message Signatures etc. That for sure required the engagement of the latest technologies and savvy approach from our developers.

Workflow

Overall Result

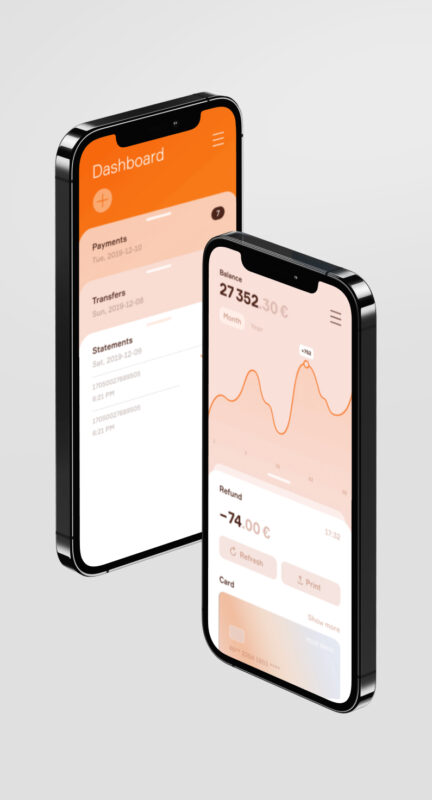

The APIs for listing account information, balances, transactions, SEPA, and Cross Border payments were successfully launched and now, due to the integral input brought by Touchlane developers, the system utilizes 35+ Nordic bank integrations.