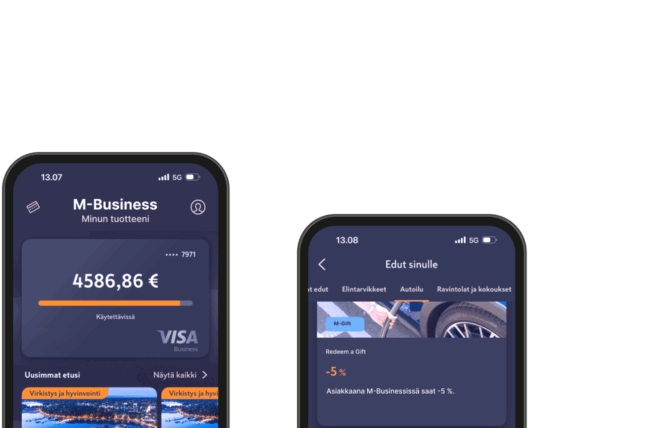

Credit Card Management App for a Long-Term Partner

Following a series of successful collaborations on mobile app development projects, our long-term client approached Touchlane with a new venture – developing a credit card management application from scratch for Finland’s largest retail network. Launched in February 2024, the project falls under the staff augmentation model.

The application supports the client by providing a secure, intuitive, and efficient card management experience.

Initial Task

Description

At Touchlane, we are working on a corporate credit card management application. Intended for Finland’s largest retail network, the app stands out for its security, usability, and intuitive design.

Its key functionality includes:

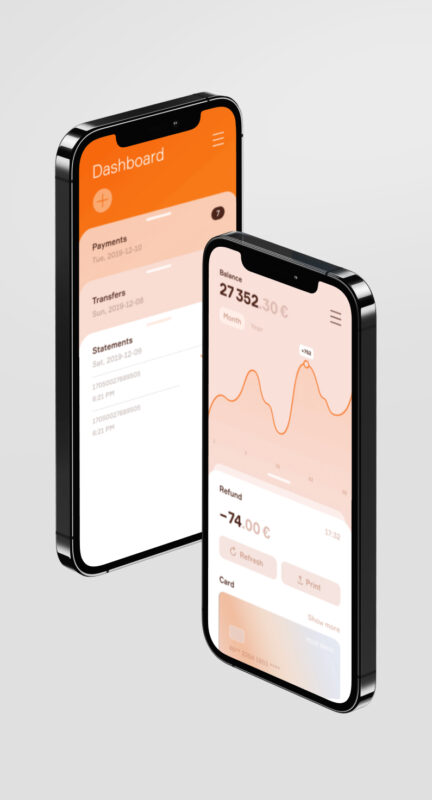

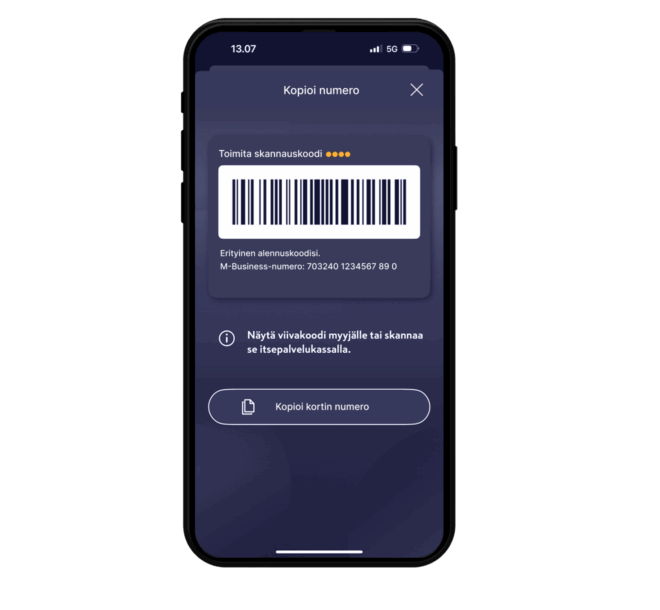

- Managing transactions. Users can keep an eye on and control their transactions within the app.

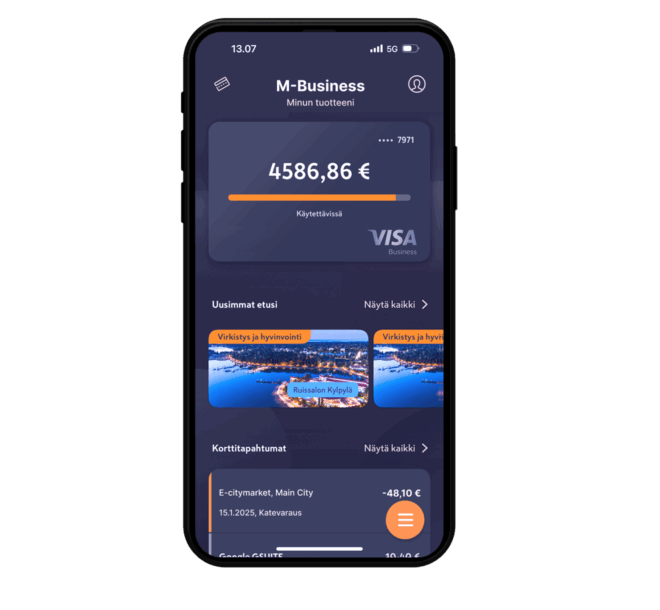

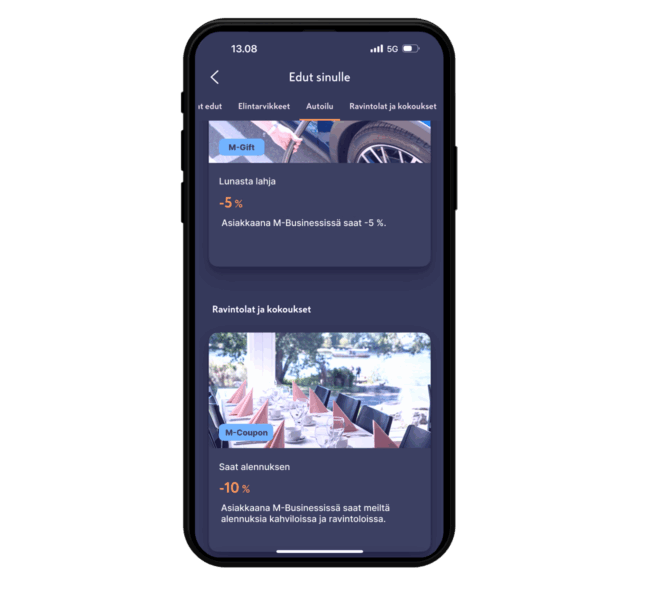

- Accessing benefits. The app provides up-to-date information about a loyalty program and partner benefits.

In addition, features like card lists, balances, and limits are available.

Our team provided iOS and Android development expertise. In this project, we built the entire application from the ground up, starting with only the business requirements and certain technical limitations as to the operation system. Our team handled the core technical consultancy, development of the application architecture, frontend implementation, and infrastructure setup.

Technology stack

iOS

Android

Challenges

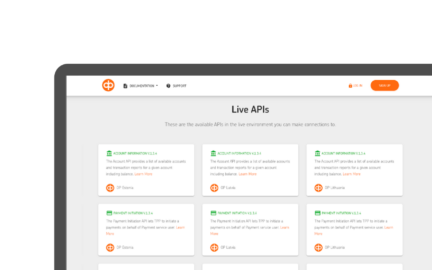

Integration complexity

The project involved integrating a third-party 3DS mobile SDK to support biometric authentication on mobile devices. This process required a deep understanding of both the SDK’s internal logic and the surrounding infrastructure.

Security compliance

Maintaining a high level of security was a central focus from the start. The work included implementing advanced encryption protocols and secure data exchange methods, as required by industry standards.

Receipt issuance challenge

The project faced a challenge in adding the receipt issuance feature as the provider lacked a unified key for transactions. Our team was tasked with creating an algorithm that matched the transaction with the corresponding receipt, despite this lack of a common identifier. The solution was to generate a receipt based on indirect factors such as transaction size, date, and location.

Development

Phase / 01.

-

In the first stage, the focus was on building the technical architecture and integrating the UI. While the design was not our responsibility, we collaborated closely with the client’s design team. To establish a structured foundation for the application's UI, Touchlane deployed a design system. This system defined typography, color schemes, and spacing to guarantee consistency among all components

-

Our team also developed key components and interactive controls that were reused throughout the project. This method made it easier to integrate technical and design elements while improving development, preserving a consistent style, and increasing scalability.

Phase / 02.

At this phase, we concentrated on creating the core functionality of the application to guarantee security compliance and smooth banking operations.

-

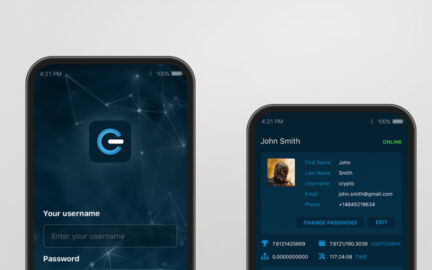

Login and authentication.

Our programmers integrated e-Ident solutions from IN Groupe and Nets for secure user authentication.

-

Core banking features.

We implemented card issuance, transaction processing, and real-time status updates through direct integration with the bank.

-

Data export and sharing.

In close cooperation with the client, we decided to extend the graphics team and look into lower level programming. We introduced a fully custom graphics framework built in C / GLSL / Objective-C, with manual memory management and integrations of CoreGraphics, SpriteKit and Accelerate which remained competitive till today.

-

Accessibility compliance.

Touchlane implemented features to support visually impaired users in accordance with the European accessibility act.

Phase / 03.

We continue to improve the application, with planned features such as 3D-Secure integration and additional usability updates.

-

3D-Secure.

Upcoming integration of the functionality for faster and more secure authentication and Click to Pay transactions.

Overall Result

Touchlane completed the development within the agreed timeline. We have received positive feedback both from the client and the app’s users. This project stood out thanks to its multiple integrations, which have become standard in Touchlane’s work.

Our team handled it confidently and delivered an app that runs fast, works smoothly, and meets all of the client’s requirements without a hitch. This result strengthens the foundation of our long-term collaboration and reflects the trust we have built through consistent, high-quality work.

Client Review

Touchlane’s open-minded team is willing to work on issues with clients and takes their feedback effectively.

The application has all the requested features and is continuously monitored for issues. Touchlane’s receptiveness to input and their dedication to the project spurred continued engagement. Customers can expect an approachable team with exceptional QA services and project management stylings.