Top fintech industry trends to embrace in 2025

Intro

The fintech sector is always changing to keep ahead of the curve as consumer tastes change and technology advances. By 2028, the U.S. fintech industry is expected to generate $70 billion in revenue and change the way we manage money. This means to be in the lead, you must understand which trends will define the market and how they can affect growth, operations, and customer engagement.

What’s on the horizon for the industry in 2025, then? What opportunities and potential obstacles might present themselves? The trends we look at today are changing the way we deal with monetary services, from AI-powered solutions to highly customized user journeys.

Fintech – Recent stats

Last year, the fintech industry experienced significant developments and trends, which resulted in both new hurdles and prospects for businesses.

Below, we present the key figures for the sector.

- With over 13,100 startups, the Americas (North America, South America, Central America, and the Caribbean) dominate the global fintech scene, highlighting the region’s role as the world’s leading financial innovation hub.

- Fintech investments achieved $43.5 billion in 2024.

- With a market worth of $65 billion as of March 2024, Stripe has become a dominant power in the private fintech industry.

The rising role of mobile applications in fintech innovation

Mobile applications are deeply ingrained in financial services as they speed up access to services and simplify transactions. Emerging technologies and rising demand for convenience and personalization drive further shifts towards mobile.

Today’s consumers expect a mobile-first experience. Neobanks like Revolut operate exclusively online, offering faster account openings, instant payments, and financial advice driven by AI. Traditional banks invest more in mobile-focused strategies to retain customers who expect frictionless journeys. Meanwhile, super apps consolidate financial services, combining banking, payments, and investments in a single platform. In 2025, businesses that embrace mobile-first trends in the fintech industry will stay ahead of shifting consumer preferences.

1.

AI-powered mobile solutions

AI makes mobile apps more intelligent and responsive to user behavior. Financial establishments and startups integrate AI-driven features to personalize services, detect fraud instantly, and automate customer interactions.

Chatbots and intelligent assistants manage account inquiries, process transactions, and provide financial guidance without human involvement. Predictive analytics helps businesses anticipate customer needs, refine credit risk assessments, and support decision-making. AI also strengthens fraud prevention by identifying suspicious activity faster than traditional systems.

As an example, we can look at Clerkie, a San Francisco-based fintech startup that has built an AI-based platform for efficient and personalized debt guidance. Clerkie integrates AI debt automation software into financial institutions’ mobile apps, helping consumers manage their debts and find solutions when facing payment challenges. The startup has raised $41 million in investment.

Source: clerkie.io

2.

Blockchain integration

Embedding blockchain technology into mobile apps offers a range of benefits like reinforced security and better trust among users. Moreover, blockchain can be applied in areas like supply chain tracking, user authentication, and digital identity verification to offer solutions that help businesses handle sensitive data more effectively.

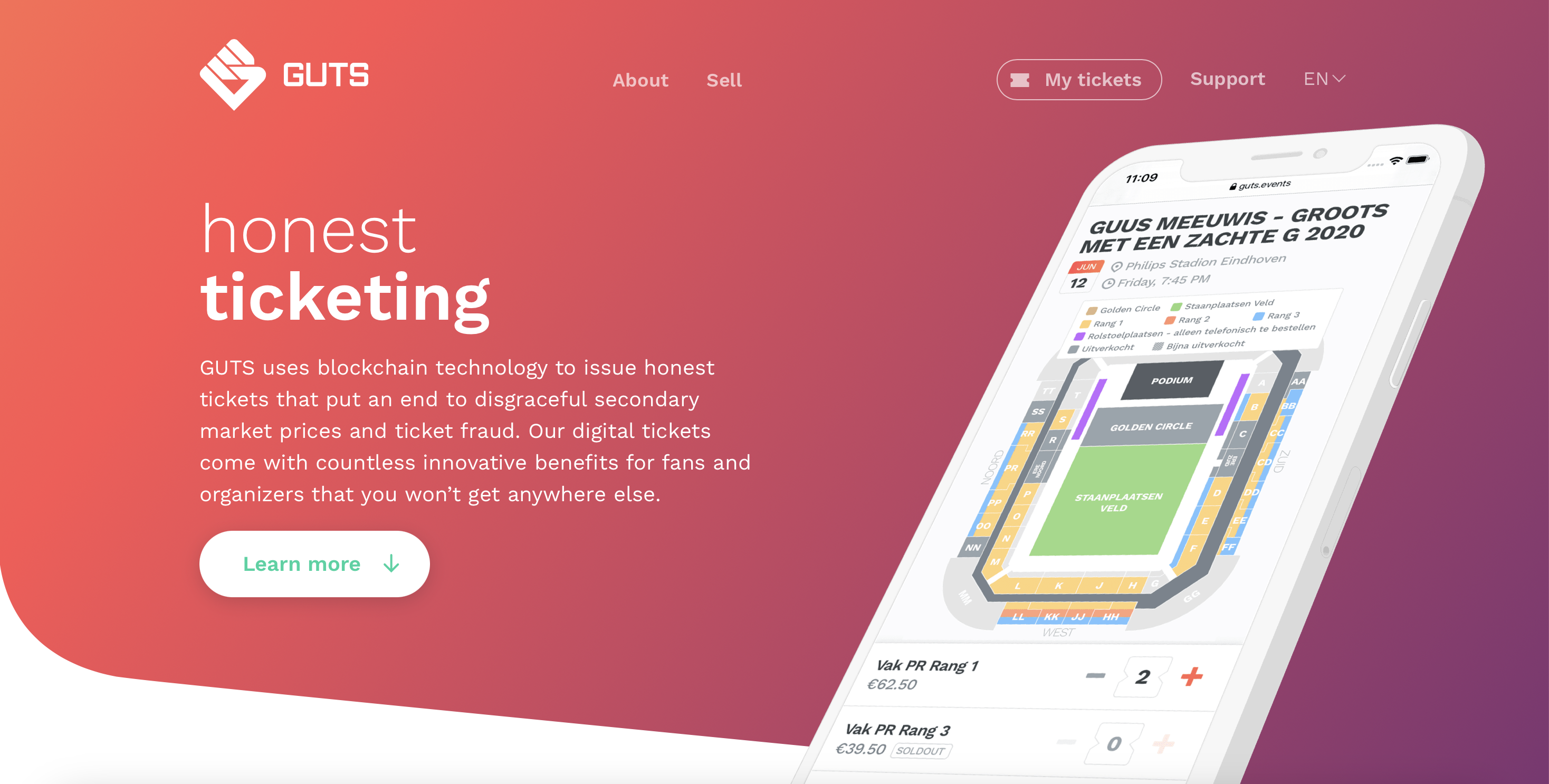

For instance, the Dutch startup GUTS Tickets employs blockchain in its smart ticketing app for releasing tickets. The app issues SMART tickets registered on the blockchain. Each ticket connects to a distinct digital identity, which prevents illegal resales and price inflation.

Source: guts.tickets

3.

Embedded finance features

Embedded financial services involve integrating banking and payment features into everyday nonfinancial apps and tools. As a result, companies can now provide transactions, financing, coverage, or asset management services within their operational structures and eliminate the need for external apps or financial institutions.

Embedded finance is not an entirely new trend. Buy Now, Pay Later (BNPL) offers third-party loans at the point of sale, often without being noticed. BNPL solutions let customers split payments into installments, which makes purchases more accessible and increases merchant conversion rates.

However, with the widespread use of APIs, consumers now access banking services anytime, anywhere. Such integration promotes customer loyalty and opens doors for businesses to explore new channels for revenue.

Lately, BNPL companies have been skyrocketing in value. Klarna, one of the most popular industry players, was valued at approximately $14.6 billion in late 2024. Its competitors, Afterpay and Sezzle, had valuations of $14.76 billion and $1.31 billion, respectively.

Examples of well-known BNPL integrations include:

- Klarna and ASOS

- Afterpay and Stripe

- Sezzle and Shopify

Source: asos.com

4.

Open banking via mobile APIs

Open banking APIs allow banks to share customer information and services securely, fostering fintech innovation. Different types of APIs offer diverse functionality and convenience for consumers. This trend results in more dynamic user journeys and more connected and functional financial ecosystems. The Open Banking framework drives higher competition and joint efforts between banks and fintech companies.

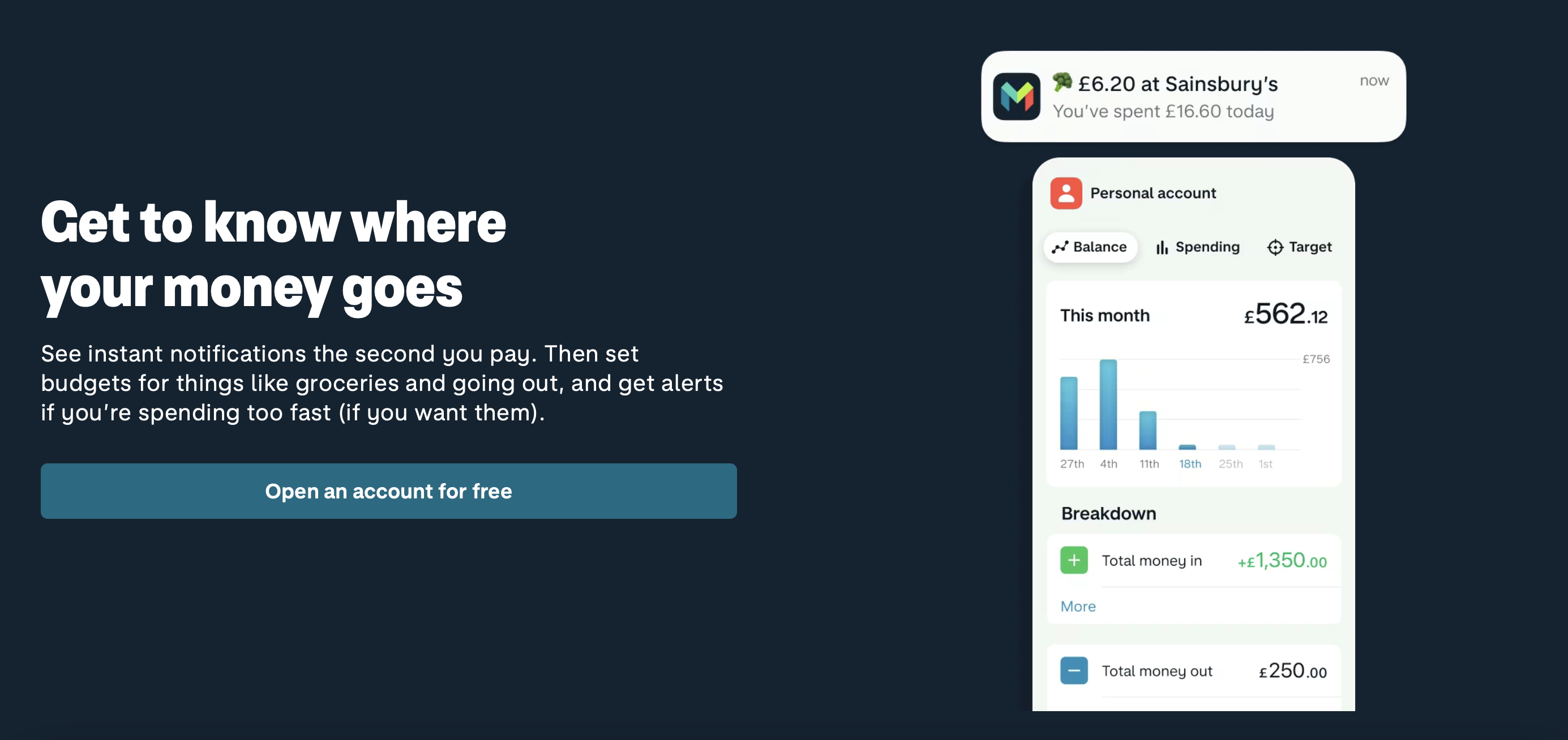

Monzo, a UK-based digital bank, integrates open banking APIs to allow users access accounts from multiple banks within its app. This provides a consolidated view of their finances without the need to switch between platforms. Monzo also offers API access to external applications and supports such features as budgeting tools and expense tracking.

Source: monzo.com

Create a fintech app that stands out

5.

Biometric authentication and security

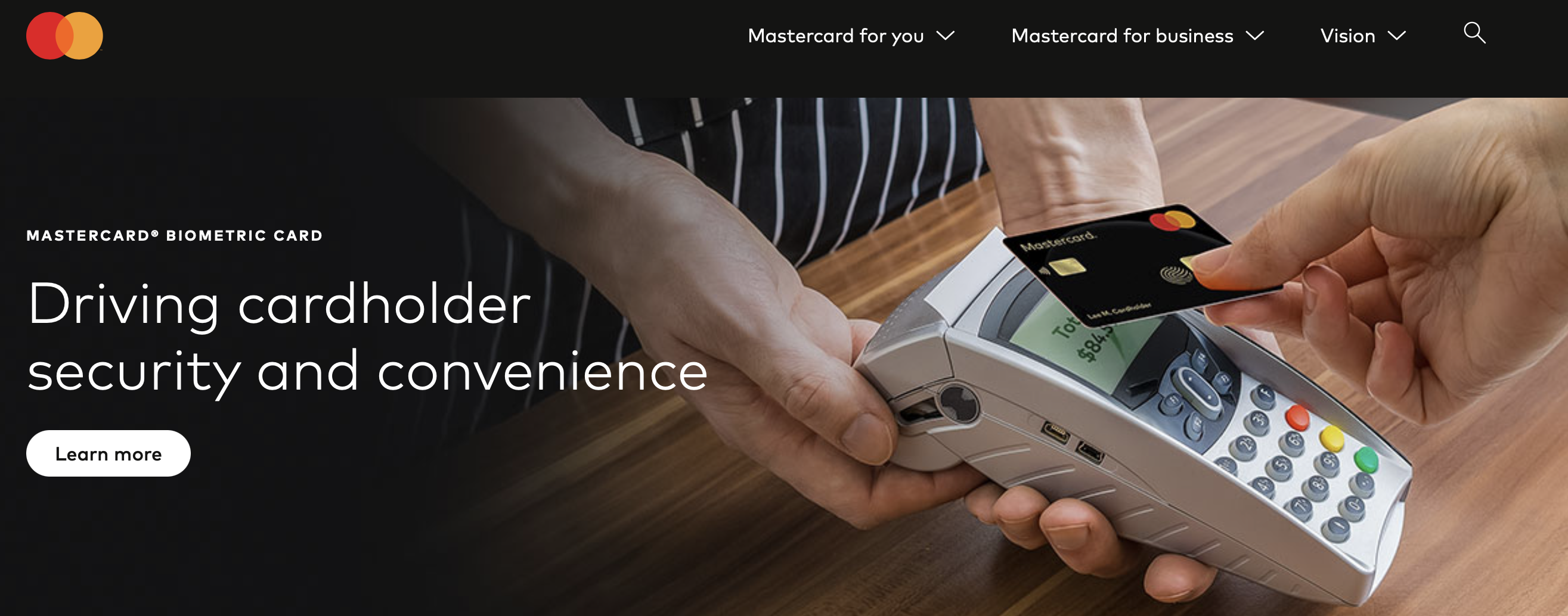

Passwords are losing ground in the fintech sector. Businesses are moving toward biometric authentication – face recognition, fingerprint scans, and even behavioral patterns – to protect transactions and user data. These methods add security while reducing friction in payment processes and app logins.

Digital banks and fintech apps integrate biometrics to verify identities and prevent fraud. Apple Pay and Google Pay employ facial recognition and fingerprint scanning to confirm transactions. The neobanks we mention above, Revolut and Monzo, rely on biometrics to block unauthorized access. Mastercard and Visa develop biometric payment cards that allow fingerprint authentication at terminals.

Stronger authentication builds trust and reduces fraud-related costs. Companies adopting biometrics gain an edge in security and customer experience, especially as cyber threats grow.

Source: mastercard.us

6.

Cryptocurrency and CBDC mobile adoption

Digital currencies are becoming more common in everyday transactions, and mobile devices are making them easier to use. Cryptocurrencies like Bitcoin and Ethereum are no longer just investments since more businesses now accept them for payments. At the same time, governments are introducing central bank digital currencies (CBDCs), which are digital versions of national currencies. Unlike cryptocurrencies, CBDCs are backed by central banks. This makes them more stable and generally accepted.

Mobile apps play a key role in this shift. Payment platforms like PayPal and Cash App allow users to buy, sell, and spend cryptocurrency directly from their phones. In China, millions already use the digital yuan, or e-CNY, through apps, with major retailers and even public transport accepting it.

For companies, this means more payment options for customers, faster global transactions, and potentially lower fees. Companies that operate internationally or want to attract tech-savvy customers should watch how different markets adopt these digital currencies.

In China, digital yuan is one of the most prominent fintech app trends

7.

Hyper-personalized user experiences

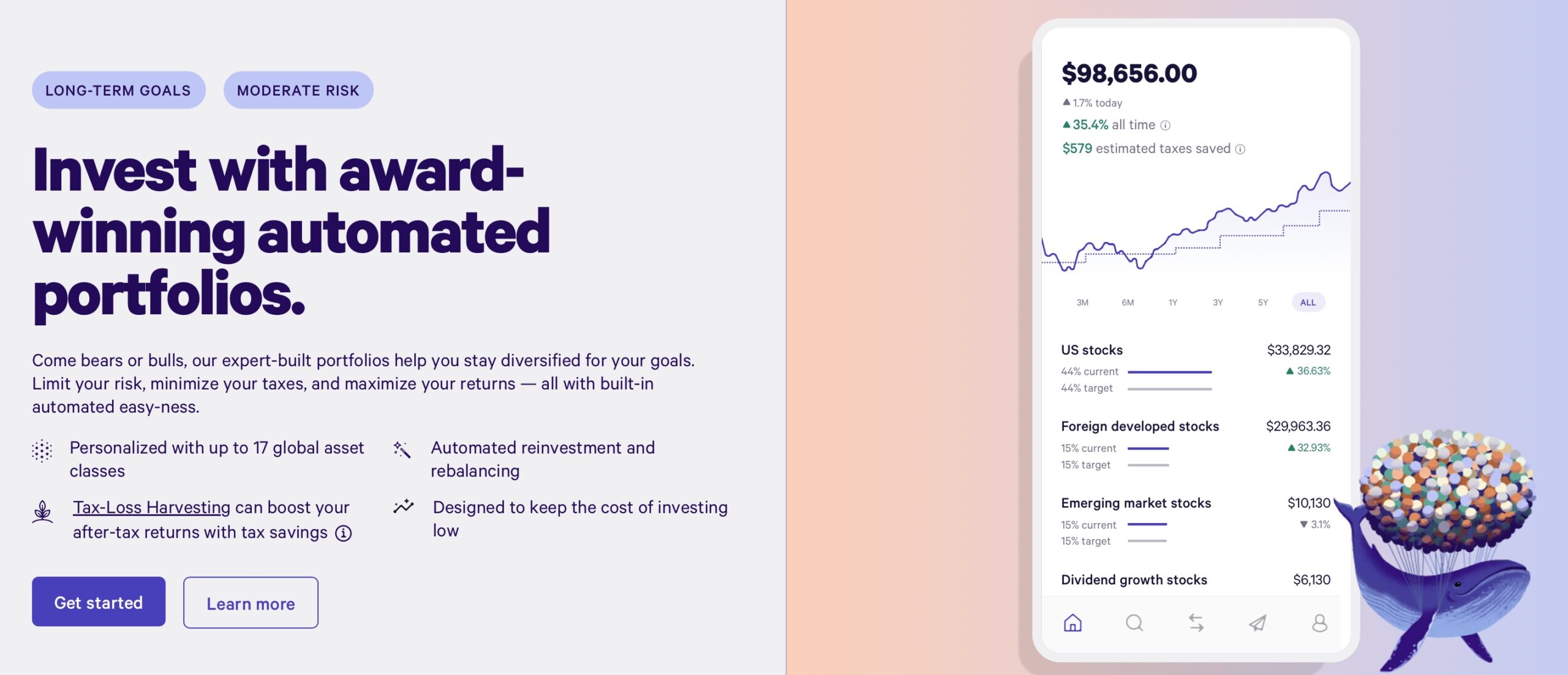

Fintech companies are moving away from one-size-fits-all solutions and focusing on client-specific services. Instead of offering the same banking, payment, or investment options to everyone, they use AI and data analysis to understand individual habits and provide recommendations that feel personal.

For example, digital banks like Monzo and N26 categorize spending automatically and suggest ways to save based on past transactions. Payment services such as Klarna and Affirm adjust payment plans depending on shopping behavior. Investment platforms like Wealthfront and Betterment create strategies that match financial goals and risk tolerance.

This shift makes financial services feel more intuitive and responsive. Customers no longer have to figure out everything themselves – apps and platforms now anticipate their needs and offer relevant options. Businesses that embrace this approach gain an edge by building stronger relationships with their customers.

Source: wealthfront.com

Conclusion – What do these trends mean for your business?

Fintech trends in 2025 will be all about smarter, faster, and more secure services. Mobile apps, AI-powered tools, and stronger security measures are becoming essential, not just nice-to-have features.

Businesses that keep up with these changes will have an easier time attracting and retaining customers. Mobile-first services, AI-driven personalization, and swifter payment options will set companies apart. Open banking and embedded finance will also create new ways for businesses to deliver financial services without needing to be a bank.

The key takeaway? Fintech is not just evolving – it is revamping how we handle money. Companies that embrace these fintech technology trends will lead tomorrow’s financial ecosystem, while those that ignore them may struggle to keep up. At Touchlane, we know how to make a trendsetting application. Feel free to contact our team to discuss how to turn your idea into one.

RELATED SERVICES

CUSTOM MOBILE APP DEVELOPMENT

If you have an idea for a product along with put-together business requirements, and you want your time-to-market to be as short as possible without cutting any corners on quality, Touchlane can become your all-in-one technology partner, putting together a cross-functional team and carrying a project all the way to its successful launch into the digital reality.

If you have an idea for a product along with put-together business requirements, and you want your time-to-market to be as short as possible without cutting any corners on quality, Touchlane can become your all-in-one technology partner, putting together a cross-functional team and carrying a project all the way to its successful launch into the digital reality.

We Cover

- Design

- Development

- Testing

- Maintenance