HOW TO BUILD A PAYMENT APP: KEY STEPS AND COST

Intro

In 2024, the worldwide mobile payment app market was estimated at $88.50 billion, and this amount is expected to increase at a CAGR of 38.0% in the 2025-2030 period. The steady rise of mobile payments is factored by the growing overall use of smartphones, mobile commerce, and high-speed internet accessibility.

To jump on the bandwagon in this regard, businesses are engineering their payment app solutions, driving competition in the niche. Given that, only mobile apps that excel in usability, robustness, and security will stand out. Experts in custom mobile app development, we know how to make things work. Read our step-by-step guide on how to build a payment app that drives revenue and lives up to customer demands.

MOBILE PAYMENT APP TYPES

If you’re in two minds about how to shake the mobile payment market, here’s an overview of solution types tailored to particular business and user needs.

1.

P2P PAYMENT APPS

Peer-to-Peer (P2P) payment apps are aimed at helping individuals seamlessly and rapidly transfer money to one another. Such apps spare users the need for cash or checks in tasks such as splitting bills, sending gifts, paying friends or relatives for particular goods or services, sending contributions, and fundraising. Among the popular examples of such solutions is PayPal, Venmo, and Zelle.

If you decide to build a payment processing app of this type, empower users not only with instant payments (as opposed to traditional bank transfers), but also add functionality like storing transaction history, generating payment requests, and collaborative budgeting.

2.

MOBILE WALLETS

These apps securely store payment data on your mobile device to further make purchases at retailers or on e-commerce websites, transfer money, or even store loyalty cards / coupons / transport passes. Popular app examples include Google Pay, Apple Pay, and Samsung Pay.

As a developer of such an app, provide NFC (Near Field Communication) capabilities for contactless payments in stores and businesses, QR code integration, expense tracking, and seamless checkout processes for m-commerce payments.

3.

BANKING APPS

Banking apps are an indispensable service for banks and fintech companies. Their clients can easily and securely manage accounts and perform financial operations in a few clicks.

Balance monitoring, money and funds transfers, bills payment, depositing checks — all this can be performed from a mobile device or a tablet without the need for a user to visit a physical bank. Chase Mobile and Bank of America Mobile Banking are great examples of these app types.

4.

E-COMMERCE APPS

Designed specifically for online shopping, e-commerce payment apps empower users with secure and effortless transactions on websites. Features of a good app of this type comprise:

- Multiple payment methods (credit/debit cards, bank transfers, cryptocurrency, digital wallets) that can be securely saved for future purchases

- Transaction tracking and spendings monitoring

- Seamless integrations with multiple online shopping platforms

- Reward capabilities (discounts, cashback, etc.)

Among famous use cases are Stripe and Square.

Interested in building a payment app? Discuss your ideas with our team

HOW DO PAYMENT APPS WORK?

If you want to know how to build a payment processing app, first go deep into mechanisms that lay behind the solution. For example, here’s how a traditional p2p app works.

- Registration and authentication. Users download the app, create an account, where they usually put their personal information (name, phone number, emails), link their credit/debit cards or other payment methods, and create a password.

- Transaction initiation starts when a user selects a recipient and enters a particular amount of money for sending.

- Once the transaction is confirmed by the user, payment processing starts. Namely, the app connects with payment processors and networks (Visa / Mastercard / ACH) for validating the payer’s and payee’s banking information.

- Approval and settlement. Once the authorization is done, the transaction is considered to be settled. The funds are transferred instantly or with some delay depending on the app performance and banking protocols.

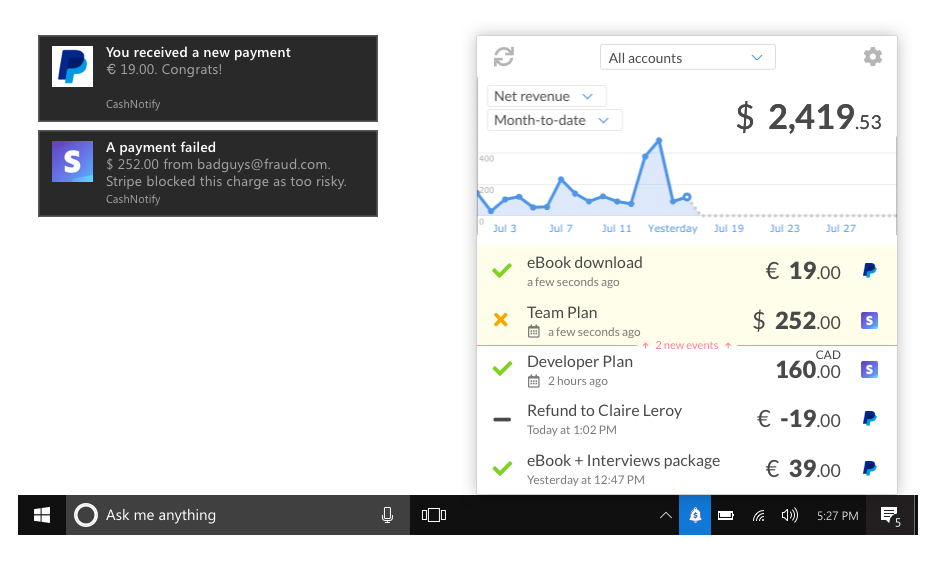

- Notifications. Both sender and recipient get notifications of the financial operation that in turn is recorded on the app transaction history.

HOW TO MAKE A PAYMENT APP: A STEP-BY-STEP GUIDE

Once you’ve made up your mind about what type of the payment solution you want to create, proceed to our walkthrough of the development process.

1.

STEP 1: CREATE AN APP IDEA

Based on the payment app type’s availability and competitor research, decide on the initial concept of your solution. Also, perform user research (interviews, surveys, etc.) to create comprehensive user personas and understand your target audience’s needs and behaviors.

With this data at hand, create a minimum viable product (MVP) of your solution — a functional app version with must-have features implemented. Such an MVP can be tested with real users and iterated accordingly.

2.

STEP 2: PRIORITIZE SECURITY

Given the sensitive nature of financial data, security is one of the first aspects to pay heed to at early development stages. Check our list of best practices to incorporate early on:

- Risk assessment and planning. From the start, you should detect potential threats to your app, including technical (vulnerabilities in code), operational (outages), market, user, and reputational risks.

- Data encryption. Encrypt sensitive data at rest and in transit, using industry-standard algorithms like AES-256 and TLS 1.2. Also, introduce a secure key management process by using unique keys for different data types or user sessions.

- Strong authentication. To ensure that only properly authorized users can access the payment app, implement multi-factor authentication (MFA). You can leverage verification methods such as passwords, SMS codes, email confirmations, biometrics (fingerprint or facial recognition), and tokens.

- In the USA, the key regulations that secure consumers from deceptive acts include Electronic Fund Transfer Act (EFTA), Consumer Financial Protection Bureau (CFPB), and Bank Secrecy Act (BSA). In the European Union, you should comply with the Payment Services Directive 2 (PSD2), Anti-Money Laundering Directive (AMLD), and General Data Protection Regulation (GDPR).

- Secure coding practices. Ensure security-first development with robust input validation, error handling, well-maintained libraries and frameworks. Introduce and clearly communicate the security policies to follow for all team members.

3.

STEP 3: FORM A DEVELOPMENT TEAM

Your core app idea should be implemented with the best team, and at this stage, you decide you want to form it in-house or outsource. When analyzing the two options, take into account the following aspects:

- Control. In-house teams usually give you more control and alignment. However, outsourced specialists can easily and rapidly adjust resources for changing project needs.

- Cost. If you perform staffing on your own, be ready for high costs in looking for potential candidates, conducting interviews, etc. Conversely, outsourcing a development team presupposes reduced overhead.

- Competence. Outsourcing seems wiser here, as you can find and hire a team with firmly established roles and a track record of the fintech projects.

4.

STEP 4: BUILD INTUITIVE UI/UX DESIGNS

Due to its niche, payment apps require maximum precision, so ensure intuitive onboarding, a logical navigation structure, fast transactions with minimum steps, concise language, customizable settings, and visual indicators for security assurance.

Also, when creating a mobile payment app, make sure it performs great across devices and screen sizes, and corresponds to the Web Content Accessibility Guidelines (WCAG) guidelines for accessibility compliance.

5.

STEP 5: BUILD CORE FEATURES

After you’ve done with the design, start building key functionality around your MVP. Here’s the list of must-have features no matter the type of payment app you choose:

- User profile. Besides enabling an easy process around registration and authentication in your app, provide an intuitive UI for profile pages, where users can seamlessly edit their personal information, update payment methods, and change passwords.

- The introduction of invoicing and billing functionality will help your users easily pay and manage bills, set up recurring payments, make p2p transfers, create customizable invoices, and perform QR code payments.

- Transaction history. Allow users to track a detailed history of all their transactions, including payments, funds, refunds, p2p transfers, and pending operations. Introduce features such as filter-based search (by date / amount / recipient, etc.), categorization (for example, online shopping, utilities, health), and export options (in CSV and PDF formats).

- Customer assistance is another must-have feature. Enable helpdesk / chatbot support for inquiries and troubleshooting, allowing users not only write, but also attach files.

- Analytics. Transaction volumes, spending trends, recurring payments, expense limits, budget tracking — allow users to get insights into their operations through dynamic dashboards and detailed reports.

- Include notifications about transactions statuses updates, balance limits, security issues, errors in operations, promotion offers, bill payment reminders, and support ticket updates.

6.

STEP 6: IMPLEMENT INTEGRATIONS

At this stage, decide what third-party integrations you should implement depending on your solution’s type.

When building a p2p app, consider pairing it up with popular gateways like PayPal, third-party APIs (like Twilio) for in-app messaging, and social media for sharing experiences.

If your solution is more business-oriented, you might need to integrate it with enterprise solutions such as accounting software, CRM systems, ERP platforms, HRMS software, project management tools, and more.

7.

STEP 7: TEST THE SOLUTION

The testing stage is for making sure your app meets the highest standards around usability, security, and performance. Test your payment solution, taking into account its specifics.

- Functional testing should include UI tests for checking app’s usability. Also, test transaction flows (for example successful / failed payment), ensure correct functioning of various payment methods, examine how your app deals with invalid inputs and errors.

- Integration testing will verify how separate modules interact with one another to detect compatibility and data flow issues. Pay attention to API testing in this regard to make sure your app works well with third-party systems.

- Security testing will help you check the robustness of handling sensitive data (credit card numbers, personal information), user authentication processes (passwords, biometrics-based access), PCI-DSS compliance, and possible vulnerabilities. Regularly perform security code reviews, monitoring and logging practices, as well as security updates and patch management.

- Performance testing should include load testing (to analyze the app performance under pressure), stress testing (to define the app’s breaking point under extreme conditions), and latency testing (to gauge response times for various processes).

8.

STEP 8: LAUNCH THE APP

Before launching a payment app, you should conduct a range of audits and licensing procedures that vary depending on the region jurisdiction and your app’s specific features. You’ll surely need audits around security, compliance, performance, app’s financial flows, and legal contracts. Among the licensing requirements to comply with is the money transmitter license, payment institution license, Electronic Money License (EMI), and banking license.

When preparing for the moment your payment app will see the light, choose a strategic launch date, paying attention to factors like competition, market trends, and user behavior patterns in your niche. If needed, make the corresponding changes, postponing the release date.

To enlarge your audience, submit the solution to both Apple App Store and Google Play. Remember to use best practices around App Store Optimization (ASO), including attention-grabbing descriptions, appropriate keywords, and catchy screenshots.

Besides, ensure post-launch support. Introduce regular performance and security monitoring to address issues on time. Collect user feedback through support functionality. Make the most of analytics to track KPIs, including download numbers, user engagement, and app abandonments.

PAYMENT APP COST ESTIMATIONS

Cost is a key aspect in your “how to create a payment app” journey. And these are the main factors that might influence the final check.

- Team expertise. More experienced developers might cost more in the beginning, but they’ll certainly slash down project expenditures throughout the development process due to higher efficacy (which means reduced labor hours) and higher quality (which means less bug-fixing).

- Feature set. The more features, especially advanced ones (for example, face recognition-based authentication), you want to implement, the more expensive your final solution will be. Customization will also drive additional expenses, but it will certainly bring more bang for your buck.

- Technology stack can notably influence the final cost of the payment app and maintenance expenses in future. Given that, perform key analytical steps, including business requirements analysis, scalability assessment, cost-benefit analysis, performance and security evaluations — to decide what programming languages, frameworks, and APIs are optimal for your particular case.

BANKING APP DEVELOPMENT: A CASE IN POINT

The client hired Touchlane as a reliable and devoted technical partner to revamp their banking app in terms of UI/UX, functionality extension, and privacy improvements.

After a thorough review of the existing solution and the client’s needs analysis, our team prepared a comprehensive roadmap of the project redesign and bug fixing and proceeded to the development stage.

We thoroughly audited the app for user data security, obtaining the highest marks from NIXU Cyber Security, a large information security firm. The new design, proposed by our team, was positively reviewed by 85% of users.

As for features updates, we implemented biometrics-based integration (including fingerprint and Face ID authorization), new card types support, mobile wallet integration (Google Pay credit & Apple Pay), a new chat with extended functionality, chart visualizations. We also reworked securities and funds sections and PIN viewing for improved security.

Conclusion

In today’s market, there’s an app for every financial operation — from simple p2p transactions to bill payments to budget analytics. Considering such a diverse digital landscape, your app should not only cater to particular user needs and preferences, but also stand out from the crowd in terms of usability, performance, and security.

If you need help in creating a non-trivial payment solution, a seasoned mobile developer like Touchlane has got your back — from app ideation and MVP creation to market launch and app maintenance.

The content provided in this article is for informational and educational purposes only and should not be considered legal or tax advice. Touchlane makes no representations or warranties regarding the accuracy, completeness, or reliability of the information. For advice specific to your situation, you should consult a qualified legal or tax professional licensed in your jurisdiction.

RELATED SERVICES

CUSTOM MOBILE APP DEVELOPMENT

If you have an idea for a product along with put-together business requirements, and you want your time-to-market to be as short as possible without cutting any corners on quality, Touchlane can become your all-in-one technology partner, putting together a cross-functional team and carrying a project all the way to its successful launch into the digital reality.

If you have an idea for a product along with put-together business requirements, and you want your time-to-market to be as short as possible without cutting any corners on quality, Touchlane can become your all-in-one technology partner, putting together a cross-functional team and carrying a project all the way to its successful launch into the digital reality.

We Cover

- Design

- Development

- Testing

- Maintenance