How to Choose the Best Payment Gateway for Mobile App and Integrate It

Intro

Choosing and integrating a payment gateway for a mobile app requires balancing multiple factors. Failing to meet such requirements can result in lost revenue, underscoring the importance of selecting the best solution.

In this post, we provide professional advice on incorporating a mobile app payment system for easy, hassle-free transactions. You will learn the crucial stages for a smooth integration and discover key factors to consider when selecting the best gateway, regardless of your role as a product manager, developer, or business owner.

Understanding Payment Gateways

A payment gateway: what is it?

A Payment Gateway in mobile applications is a financial technology designed to process electronic payments securely. It enables seamless in-app purchases, handles credit and debit card transactions on online platforms, and efficiently supports card-not-present scenarios. By doing so, it connects clients, merchants, and financial institutions.

“Secure” means ensuring that bank account details, credit card numbers, and digital wallet credentials, among other private payment information, are protected from potential threats such as fraud or data breaches.

“Processing” refers to the entire sequence of steps involved in handling payment information. This includes capturing the transaction request, sending it to the payment processor, and getting word from the bank regarding its approval or rejection.

Payment gateways facilitate transactions between mobile app users and providers (such as digital platforms that supply content, e-learning, or SaaS) or vendors (like online merchants or subscription platforms).

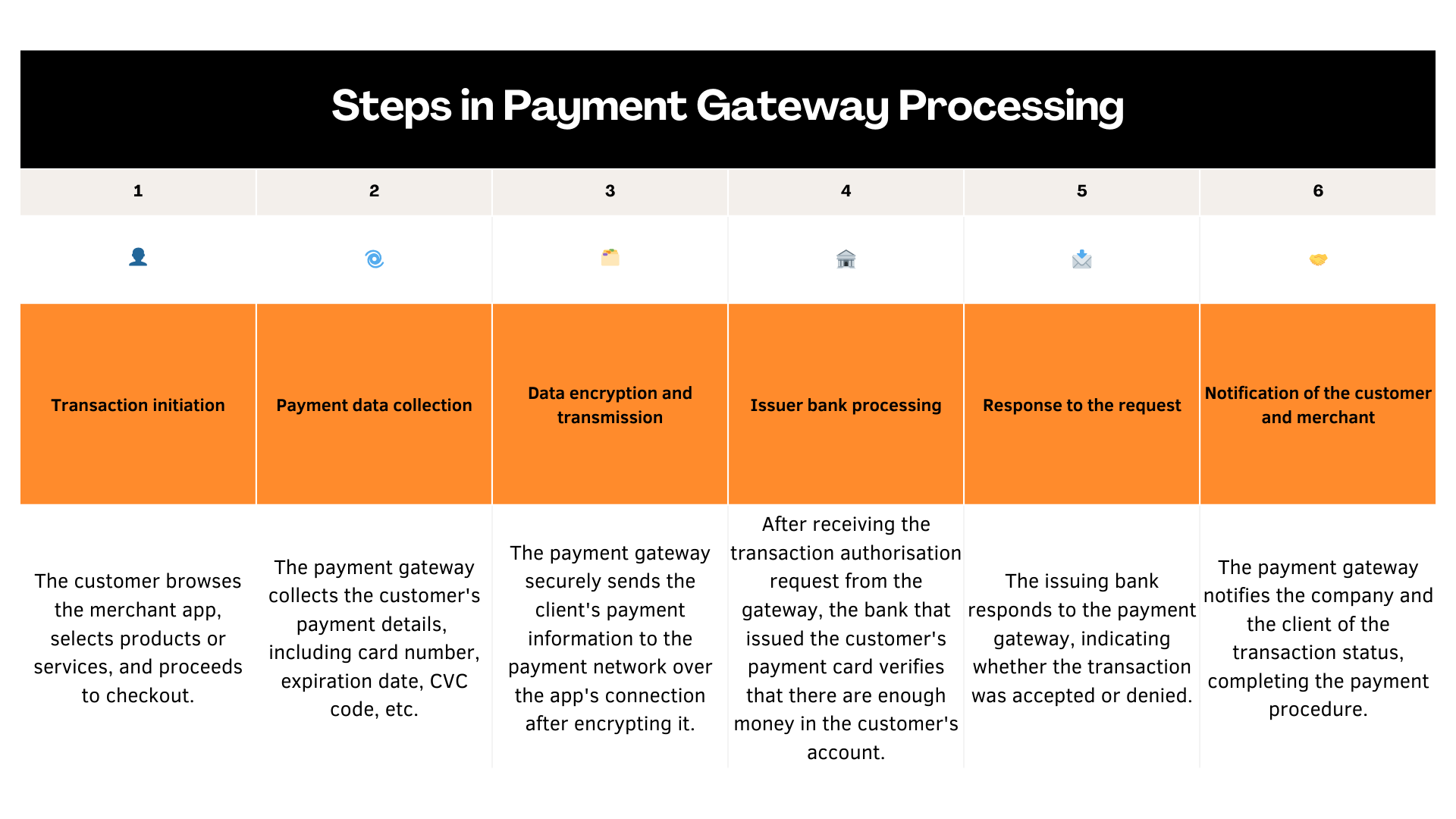

How do payment gateways work in mobile applications?

For example, payment gateway applications handle the secure transfer of information (such as credit card details) and complete the transaction (such as deducting funds from the user’s account) when a user purchases through a mobile application. After that, it informs the merchant and the customer of the transaction status, including if there was a problem or whether the operation was completed successfully.

6 Factors to Consider When Choosing a Payment Gateway for Mobile Apps

1.

Security and compliance (PCI DSS standards)

- Relevant for:

Any business that handles customer payment information, particularly those in financial services, subscription-based apps, or mobile retail. - Why:

To protect customer data and ensure safe transactions, it is crucial to maintain high security and PCI DSS compliance, especially when it comes to mobile app payment integration. Noncompliance can result in legal issues, reputational damage, and a hard-to-regain loss of client trust. Without proper measures, unauthorized access and fraud are more likely to occur, potentially causing long-term harm to the business. - How to consider:

Verify that the mobile app’s payment gateway conforms with the most modern PCI DSS rules, incorporating secure data transmission, access control, and robust encryption, to guarantee the highest level of transaction security. Find out whether the supplier employs encryption technologies like TLS and offers continuous monitoring and fraud detection features like real-time transaction tracking and anomaly detection to strengthen the security of your mobile app.

2.

Supported payment methods (credit cards, digital wallets, etc.)

- Relevant for:

Apps aiming to enhance user experience, as well as businesses involved in digital services. - Why:

Providing a range of options may boost conversion rates and enhance customer satisfaction. A variety of payment options are expected by customers, such as credit/debit cards, digital wallets (like Apple Pay and Google Pay), and alternative payment methods (including Buy Now Pay Later and UPI).

How to consider:

Verify that the gateway supports all the payment methods commonly used by your target audience. Make sure the mobile application’s payment gateway has no issues connecting with your app’s user interface or user experience. Observe new developments, like cryptocurrency or regionally unique systems, to make sure you’re future-proof.

3.

Support for currencies and geographic availability

- Relevant for:

Businesses targeting global markets, such as travel services, and subscription-based models with international clientele. - Why:

Supporting a wide range of currencies and languages is essential for companies operating across multiple regions. Payment gateway apps that enable international transactions with minimal fees and complexity provide a seamless experience for global customers.

How to consider:

Investigate the gateway’s geographical coverage and the number of currencies it supports. Look for options that enable easy conversion without imposing excessive international fees. Consider whether the provider accommodates local payment methods for particular markets (e.g., Alipay in China, UPI in India).

4.

Transaction fees and pricing models

- Relevant for:

Applications for membership-based services. - Why:

Transaction fees have an effect on profitability, particularly for businesses that deal with big payments or frequent microtransactions. Understanding pricing models is crucial for budgeting and setting competitive cost strategies.

How to consider:

Analyse the payment gateway’s fee structure, including transaction costs, setup expenses, and recurring charges such as monthly subscription rates or additional service fees. Seek out vendors who offer bulk processing discounts, reasonably priced price tiers, or tailored solutions.

5.

Scalability for future growth

- Relevant for:

Startups and rapidly expanding businesses in sectors such as SaaS and fintech, particularly those anticipating a significant increase in transaction volume over time. - Why:

A scalable gateway ensures that as the business grows, it can handle increased payment volumes without compromising on performance, reliability, or security. This flexibility is particularly important during times of heavy transaction, such as seasonal increases or promotional sales. It not only prevents service disruptions during these times but also supports the company’s expansion into new markets and geographies, ensuring long-term growth and operational efficiency.

How to consider:

Evaluate whether the payment gateway for Android and iOS apps offers scalable features, such as the ability to add new methods, currencies, and additional integrations.

6.

Integration complexity and developer support

- Relevant for:

Tech-focused applications with in-house development teams, such as those from mobile developers, SaaS providers, and financial institutions. - Why:

A smooth integration process reduces development time, minimizing delays in app launches or feature rollouts. Strong developer support ensures quick troubleshooting and seamless implementation of updates, which is crucial for maintaining a competitive edge in fast-moving industries. - How to consider:

Examine the payment gateway developer documentation, APIs, SDKs, and available plugins for ease of integration into your mobile app. In order to guarantee a seamless deployment and future updates, look for a system with extensive support, including committed technical assistance.

Need help with payment gateway integration?

Things to Do When Integrating a Payment Gateway in a Mobile App

1.

Step #1— Selecting the right SDK or API for integration

Project managers should assess SDK and API alternatives for scalability, documentation quality, and compatibility, particularly when thinking about integrating payment gateways into mobile applications.

Why it matters:

- Guarantees development with few technical obstacles.

- Complies with industry standards like PCI DSS, ensuring compliance and security.

2.

Step #2 — Setting up developer accounts with the payment provider

Supervision is necessary to ensure that sandbox credentials (temporary test credentials used for simulating transactions), API keys, and other necessary resources are set up safely.

Why it matters:

- Lowers the likelihood of payment processing mistakes.

- The payment system may be easily integrated and tested without having to deal with configuration or security issues later.

3.

Step #3 — Implementing front-end and back-end components

Development team leaders should ensure seamless integration between front-end and back-end components of the payment gateway. This includes overseeing secure form implementations, tokenization, encryption, and creating robust back-end server endpoints for transaction processing.

Why it matters:

- Ensures a secure and smooth payment flow for users.

- Guarantees efficient communication between the client and server for reliable transactions.

4.

Step #4 — Testing the payment process (sandbox vs. live environments)

Technical teams should prioritize testing in a sandbox environment to simulate real-world transaction scenarios, such as approvals, declines, and edge cases. After sandbox validation, it’s essential to conduct controlled live transactions with small payments to verify the performance of the iOS payment gateway as well as its Android counterpart.

Why it matters:

- Helps identify issues early, minimizing the chances of failures during live transactions.

- Enhances user experience.

Security Best Practices for Payment Gateway Integration in Mobile Apps

Adhering to best security practices not only mitigates the risk of data breaches but also ensures compliance with industry standards such as PCI DSS.

1. Encrypting Sensitive Data

The core of this security practice lies in protecting sensitive data from unauthorized access during transmission and storage. By encrypting sensitive information, such as credit card details and personal info, it is transformed into a format that cannot be read or tampered with by unauthorized parties.

Implementing encryption standards like AES (Advanced Encryption Standard) ensures that even if this data is intercepted — whether during transfer or while stored on servers — it remains unreadable without the proper decryption key. This reduces the risk of unauthorized access to sensitive information and helps meet regulatory standards that require the protection of cardholder details, both for a payment gateway for Android app and iOS platforms.

2. USING TOKENIZATION FOR CARD DETAILS

By replacing real card details with randomly generated tokens, IT professionals can significantly reduce the likelihood of data theft. Tokens are useless outside the specific transaction context, which limits the potential damage if an attacker gains access to the information.

3. REGULARLY UPDATING LIBRARIES AND SDKS

This practice helps minimize the risk of exploitation through outdated components and strengthens the overall security of the mobile app’s payment gateway.

4. MONITORING AND AUDITING TRANSACTIONS

Specialists must implement real-time monitoring systems that flag suspicious activities, such as unusual patterns or failed payment attempts. Auditing capabilities, such as logging transaction data, provide the transparency necessary for compliance with regulatory requirements and support post-incident analysis.

Payment Gateway Types and Providers

When selecting a payment gateway, it’s helpful to consider popular options and their unique features. Here are some of the top providers:

Stripe

Stripe is a developer-friendly platform known for its robust API and extensive customization options. It supports a wide range of payment methods and currencies, making it ideal for global businesses.

PayPal

PayPal is a widely recognized payment gateway that offers simplicity and trust. It supports credit cards, debit cards, and PayPal accounts, catering to a broad audience.

Razorpay

Razorpay is an emerging player in the payment gateway space, especially popular in India. It supports multiple payment methods, including UPI, wallets, and cards, with a seamless checkout experience.

Square

Square provides an all-in-one solution for businesses, including point-of-sale hardware and online payment processing. It’s an excellent choice for small to medium-sized enterprises.

Simplify Payments in Your App

How to Integrate a Custom Payment Gateway Into an App?

Example of a banking app integration

Background:

One of Finland’s leading savings banks was seeking to rework and expand the app’s functionality, focusing on mobile app payment integration, while ensuring top-notch security and compliance with financial regulations.

Integration Process:

We integrated the Samlink API to ensure secure and efficient payments, reducing the likelihood of errors and disruptions. Special attention was given to protecting data by implementing encryption, tokenization, and two-factor authentication. Simultaneously, we updated the UX/UI to improve navigation and added new options like VISA and mobile transactions to enhance user convenience.

Conclusion

As we move into 2025, the growth of mobile payments, AI-driven fraud detection, and blockchain technology are setting new standards for security. By implementing a robust iOS and Android payment gateway today, you ensure a smooth and protected experience for your customers while staying ahead of the curve.

RELATED SERVICES

MOBILE BANKING SOFTWARE DEVELOPMENT

One of the best examples of staff augmentation cooperation model, where our unmanaged team of experienced iOS, Android and QA engineers has completely reworked and significantly expanded mobile application of one of the leading Finnish banks.

One of the best examples of staff augmentation cooperation model, where our unmanaged team of experienced iOS, Android and QA engineers has completely reworked and significantly expanded mobile application of one of the leading Finnish banks.

We Cover

- Design

- Development

- Testing

- Maintenance