Mobile banking app development: How to do it right and what challenges to expect

Intro

Fintech is on the continuous rise, and mobile banking is no longer a luxury but a prerequisite. The statistics on banking app usage suggests that by early 2024, 63% of bank account owners in the United States reported using mobile banking services on their smartphones or tablets.

This comprehensive guide aims to help you, as a startup founder or tech company owner, understand the essential aspects of building a mobile banking app and how to steer clear of typical mistakes.

What is mobile banking, and how does it work?

Mobile banking has come a long way since its early days of SMS-based transactions. Today, it is a powerful tool that puts a world of monetary services at your fingertips.

Mobile banking has overhauled personal finance. It provides hassle-free access to bank accounts and products through smartphones and tablets. From monitoring balances to applying for loans, users can oversee their financial affairs with ease. Powered by APIs, these apps seamlessly integrate with bank systems, securing safe and immediate transactions. Processing in real-time allows for instant transactions and alerts, giving customers quick account access. Modern banks also use AI and machine learning for tailored service delivery, like custom advice on finance matters and automated support via chatbots.

The workflow for designing a mobile banking app

Profitable iOS and/or Android banking app development encompasses a calculated approach that surpasses tech considerations. To assist you in navigating this process, follow the structured guide curated by Touchlane’s mobile team.

1.

Define your audience segment

The first crucial step is identifying your prospective audience. We have observed that our clients typically start by considering segments. These could be tech-savvy millennials, small business owners, or underserved communities. Each group has distinct preferences, and their apps are designed to accommodate these effectively.

For instance, younger generations of consumers might appreciate more progressive features such as built-in tools for budgeting or smooth integration with digital wallets. Meanwhile, small business owners could prioritize functionalities like cash flow tracking, simplified loan applications, and payroll management.

Additionally, successful clients clarify their goals for the app upfront. Whether they aim to deliver a fast and functional product or aspire to lead in industry innovation, this foundational understanding will impact their decisions on costs and the app’s toolset. And while we cannon guide you on what you should create for success, we can support you in the execution of your vision.

2.

Pinpoint the essential components of mobile banking

The components of your application will be influenced by your business model and intended user base. In addition, the cost of developing a banking app highly depends on its set of functions.

Based on our experience, tech companies generally begin with essential functionalities common to popular banking apps. Here are some of them:

- Account control. Customers can obtain balance updates, inspect transaction records, and handle account administration.

- Funds transfers. Rapid cross-account or P2P transfers are enabled via the app.

- Bill settlements. Consumers can settle bills directly through their gadgets.

- Mobile check deposits. Some apps allow users to place checks into an account via a photo submission.

- Financial planning tools. Applications often include budgeting solutions, savings plans, and investment tracking.

3.

Speedup with proper tech-stack

Having a solid tech stack can really speed things up, keep your app secure, and help it grow over time. When building fintech apps, focus on making sure they perform well, are secure, and work on different platforms. Below are some great options to explore.

Frontend

While using cross-platform solutions like React Native or Flutter can effectively slash the development cost of your banking app, it is often recommended to consider native development. These kinds of apps are difficult to create utilizing cross-platform frameworks because they usually have high security requirements and complicated functionality. From our experience, native development has proven to be the preferred approach among banking app developers.

Backend

Based on your app’s functionality, we recommend going with a trustworthy programming language for backend framework, such as C# or Java, to handle real-time transactions smoothly and securely.

! We have a comprehensive overview of programming languages. Check it out!

Database

Implement PostgreSQL, MySQL, or cloud-based alternatives like AWS RDS to effectively manage secure transactions and facilitate user data storage.

Cloud environment

The banking sector is famously known for its tight security and preference for keeping data on proprietary physical servers. However, as the industry is undergoing rapid digitization, some of the banking institutions choose well-known out-of-the-box cloud solutions.

If you think about one as well, opt for AWS, Microsoft Azure, or Google Cloud to host your banking app on reputable platforms with scalability and advanced security functionalities.

Touchlane’s guide on the Big Three cloud platforms

4.

Safety first

The security value of mobile banking apps cannot be overstated. Users must have confidence in the protection of their funds and personal data. Here are key security features that are essential, as well as security protocols to follow.

Data encryption

Guarantee that all data transactions are protected with end-to-end encryption for enhanced security.

Fraud detection

Utilize machine learning algorithms to monitor and block potentially fraudulent activities in real-time.

Biometric authentication

Incorporate fingerprints or facial recognition to provide an additional security layer through biometric authentication.

Multi-factor authentication (MFA)

Combine traditional passwords with SMS or email verification as part of a robust multi-factor authentication strategy.

Legal requirements

The fintech sector is subject to stringent regulations – in fact, it is one of the most regulated sectors overall. Beyond the technical challenges, startups and SMBs face the daunting task of navigating intricate legal requirements. Non-compliance with data protection laws (like GDPR) or financial regulations (such as PSD2) can lead to hefty fines and undermine user trust.

5.

The essential role of APIs in banking app development

APIs are the heart and soul of mobile banking applications, facilitating the incorporation of multiple services without the need for redundant development. They facilitate secure, instantaneous communication with core banking platforms and payment gateways.

Open banking APIs

These APIs facilitate access to customer financial information (with permission), empowering you to offer personalized financial solutions

Payment gateway APIs

For P2P transfers and bill payments, it is essential to connect with trusted payment gateways such as Stripe, PayPal, or Adyen.

Biggest challenges of mobile banking app development and how to eliminate them

Building a mobile banking app encompasses more than mere code; it entails expert navigation through an array of technical, regulatory, and strategic complexities that affect user satisfaction and compliance. As a trusted development partner, we understand the nuances of them – and have mentioned some previously, notably, the importance of security. Let’s examine a number of the critical challenges you may encounter throughout this procedure and see what you can do to avoid – or eliminate – them.

Integration with legacy systems

A notable technical obstacle in mobile banking app development is integrating with legacy banking ecosystems. A number of the top-tier financial institutions still rely on decade-old systems, which were not designed for modern APIs or mobile interactions, potentially creating bottlenecks. These gaps can be filled by an experienced partner who is knowledgeable about core banking systems and API integrations.

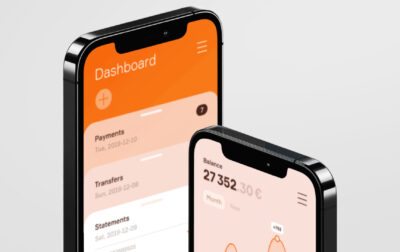

UX/UI

In the fintech environment, application design plays a pivotal role in determining success. Consumers of mobile banking applications expect an intuitive and frictionless journey that combines aesthetic appeal with ease of navigation. The challenge lies in balancing simplicity with the complexity of financial functionalities. For startups, we recommend prioritizing UX/UI from the beginning, as effective user onboarding is crucial for competing with more established entities in the market.

Scalability

As your app attracts more users, it is vital to manage increased traffic, complex transactions, and large data volumes without running into performance issues. Ensuring scalability is essential, especially for fintech startups eager for rapid growth. This means you need to think ahead and plan for future expansion by selecting a tech stack that scales efficiently, along with cloud infrastructure that supports rapid deployment and horizontal scaling.

How Touchlane empowers startups & SMBs in mobile banking app development

At Touchlane, we have solid expertise in delivering multifaceted solutions for the banking and finance sector and know intimately how banking and finance app development works. As an example, you may take a look inside our standout fintech projects.

With this accumulated experience, Touchlane can produce a client-focused banking application – and make it crash-free, efficient, and future-proof. Our team also cares greatly about security and uses strict security protocols for mobile banking app development. Touchlane-designed applications excel in security audits, achieving top ratings for reliability and protection.

If you are looking for a technical partner who knows the industry intricacies, get in contact with our team to talk about your needs.

Conclusion

As the economic environment evolves, finance tech startups and small companies have an alluring prospect to disrupt conventional banking by releasing modern and accessible mobile banking solutions. Eventually, by focusing on strategic foresight and selecting the fitting tech stack, as well as joining forces with a capable collaborator for development, you can turn this vision into a prosperous venture.

RELATED SERVICES

CUSTOM MOBILE APP DEVELOPMENT

If you have an idea for a product along with put-together business requirements, and you want your time-to-market to be as short as possible without cutting any corners on quality, Touchlane can become your all-in-one technology partner, putting together a cross-functional team and carrying a project all the way to its successful launch into the digital reality.

If you have an idea for a product along with put-together business requirements, and you want your time-to-market to be as short as possible without cutting any corners on quality, Touchlane can become your all-in-one technology partner, putting together a cross-functional team and carrying a project all the way to its successful launch into the digital reality.

We Cover

- Design

- Development

- Testing

- Maintenance